Gulf Islands property owners started the new year with new assessed property values — and they’re lower, at least for most residential parcels.

But sussing out the trend from 2022 to 2023 will be more difficult for islanders this year, due to changes in the BC Assessment Authority’s reporting. Those changes include electing to group together Salt Spring Island with what used to be considered a distinct outer island “neighbourhood” — a designation in last year’s report that included Pender, Saturna, Mayne and Galiano islands.

While not broken down by neighbourhood, the “typical” residential property in the broader Gulf Islands was assessed at $850,000 for this year, according to a fact sheet, down roughly three per cent from last year’s $874,000.

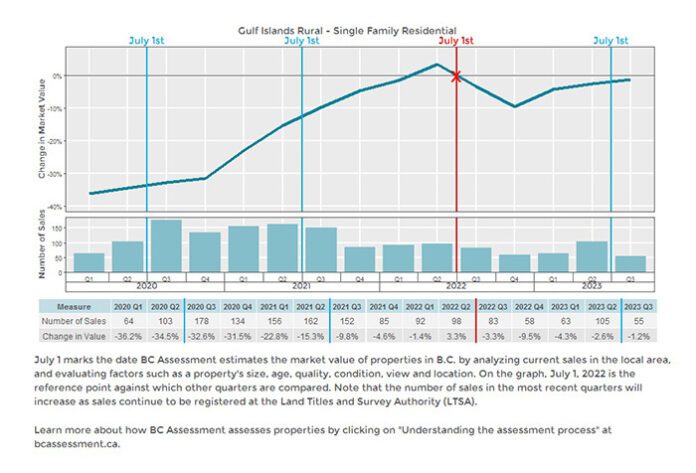

So-called single family residential properties were assessed at 3.4 per cent less, as measured from July 1 of each year, according to officials; strata property similarly lost 3.2 per cent in assessed value.

In contrast, commercial parcels saw valuation gains — averaging four per cent locally, according to BC Assessment’s neighbourhood data, with “light industry” in the Gulf Islands rising 0.7 per cent in assessed value. The trend is similar in nearby areas; North Saanich saw more modest losses in value across residential properties — less than 1 per cent — but commercial and light industry parcels gained 5.1 and 11 per cent respectively. District of North Cowichan residential values fell 3 per cent for both single family and strata residential properties, while business and light industry values jumped 2.8 and 9.1 per cent.

The total value of all real estate on B.C.’s 2024 Assessment Roll is $2.79 trillion, an increase of just 3 per cent from 2023.

The province has said a change in assessment value does not necessarily mean property taxes will go up or down by a corresponding amount; taxes are most affected if a specific property rises above (or falls below) the average value change in its geographical area. If tax rates rise enough, however, even a property with falling value could face a higher bill.

To see the assessed value of a property, visit the website bcassessment.ca and enter the address or parcel number. Property owners concerned about their assessments can find contact information there as well, if they feel their valuation or other information is incorrect.

“Those who feel that their property assessment does not reflect market value as of July 1, 2023, or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January,” said deputy assessor Matthew Butterfield.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by January 31st, for an independent review by a Property Assessment Review Panel.”

The Property Assessment Review Panels operate independent of BC Assessment, are appointed annually by the provincial government, and typically meet between Feb. 1 and March 15 to hear formal complaints.

SIDEBAR

The higher-value parcels, at least in the Gulf Islands, were not immune from drops in assessed value.

A property encompassing a home and land on the entirety of Samuel Island — between Mayne and Saturna Islands — was valued at over $19.4 million, down from $20.7 million last year. To the south, Forrest Island was assessed at $14.6 million, down from $15.2 million. Domville Island dropped to $16.1 million from $17.1 million; and James Island — the top-valued residential property in the Vancouver Island region — is valued at $57.9 million, down from $61.2 million.

James Island’s value placed it third among all residential properties in B.C., behind two single family homes in Vancouver’s Kitsilano and Point Grey neighbourhoods.

A home and acreage at the tip of Scott Point on Salt Spring Island, which last year had been valued at just under $13.2 million — $2.3 million more than the previous year’s assessed value, or about a 20.7 per cent increase — fell off the province’s top 500 valued residential properties list this year, coming in at $11.7 million. Outside of the privately-held islands, that property is still the highest-valued home in the Gulf Islands, resting at not quite $1 million higher than its assessment two years ago.